Change 2025: A surge in scrutiny – Yvonne Connolly, Managing Director, Country Head Ireland

The investment industry is entering a new age. Tougher competition, tightening margins and stringent regulatory oversight are putting pressure on fund managers. At the same time, institutional investors are demanding diversification in the face of continued market volatility – and all while expecting better governance and higher standards.

Amid the complexity, Carne’s second annual Change report tells a story of both headwinds and tailwinds – fund managers and institutional investors alike are predicting a growth fuelled year ahead despite facing these mounting pressures. We surveyed 251 C-suite fund management executives and 200 institutional investors, collectively responsible for $4.6 trillion assets under management, on their strategy for the year ahead.

Change 2025: A surge in scrutiny

Yvonne Connolly, Managing director, Country Head Ireland

Higher standards beget outsourcing

Hundreds of asset managers and investors are united in their view that the benefits of asset growth, new markets and new products are causing a surge in scrutiny.

This scrutiny is sourced from both regulatory oversight and from institutional clients who demand higher standards and transparency.

Regulation and governance have always been important to managers. This is not in dispute. Yet our research shows client expectation now precedes the growing burden of regulation when it comes to managers under to microscope.

Our latest research – with 200 professionals at pension funds, wealth managers and other institutions – indicates the optimal way to address such client scrutiny is to outsource.

In fact, some 88% of fund management respondents expect to increase their use of third-party service providers over the next 12 months, with 49% doing so materially.

Once, a manager might outsource to better manage costs. Now, such professionals say this is the least important reason to appoint third parties. This a comprehensive change: the modern era sees optics prevail, with managers more focused on meeting client expectations.

We asked managers’ clients the same questions; and 67% of them will also place more reliance on third-party service providers this year. This is also a noteworthy change from just 20% last year.

The role of management companies

If the case for outsourcing is increasingly clear cut, the question of how to outsource remains.

After all, clients are essentially asking for better governance and transparency while at the same time expecting managers to broaden their product and distribution range, deliver the same results, and not increase fees.

Management companies are seen as a key component to enable managers to meet these expectations.

For example, at the moment when it comes to fund management structure:

- 49% of fund managers use their own in-house structure to manage funds,

- 37% outsource to a management company or third-party,

- and 14% use a white label platform.

In five years, those numbers should, respectively:

- tumble to 35%,

- rocket to 52%

- and stay at 14%.

Again, this is a noteworthy change.

Better corporate governance

Poor standards of corporate governance are a substantive reason to reject a manager – indeed 87% of clients say they made this decision in the last five years. What’s more, 29% of clients say such incidents are on the rise.

Clients are scrutinising the independence of directors of funds, the regularity of board meetings and how many fund directors are on the board of funds.

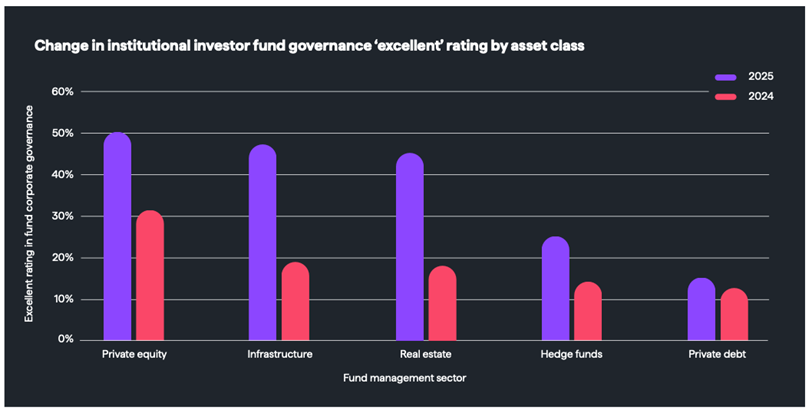

Conversely, managers are acting – implementing improvements – and clients are noticing. This is broadly asset class agnostic, although clients were especially praiseworthy of enhancements at hedge fund and private equity firms. And, as the chart below illustrates, infrastructure firms have perhaps leaped the furthest.

Funds domiciled in Luxembourg and Ireland have both seen big improvements in the way corporate governance is perceived by investors.

It is clear that fund managers need more support than ever before as they look to other sources of

new capital – while operating with greater efficiency and demonstrating they have upped their corporate governance game.

If you would like to know more about the report – or how Carne can support your organisation in navigating change successfully, please get in touch on, contact@carnegroup.com.

You can also Download the full report to learn more.