The supermodel era: The root causes of operational complexity – Siobhan Noble, Managing Director

The supermodel era: The root causes of operational complexity – Siobhan Noble, Managing Director

Pinpoint of view

Asset management operating models are changing. New products and new distribution models have transformed the industry. This has brought benefits and growth – but also costs and complexity. To succeed, asset managers now require leaner, more agile operating models that allow them to prioritise performance, products, distribution and clients. Our latest research initiative[i] shows that this is propelling asset managers into a supermodel era, of necessary, radical and lasting change to operating models.

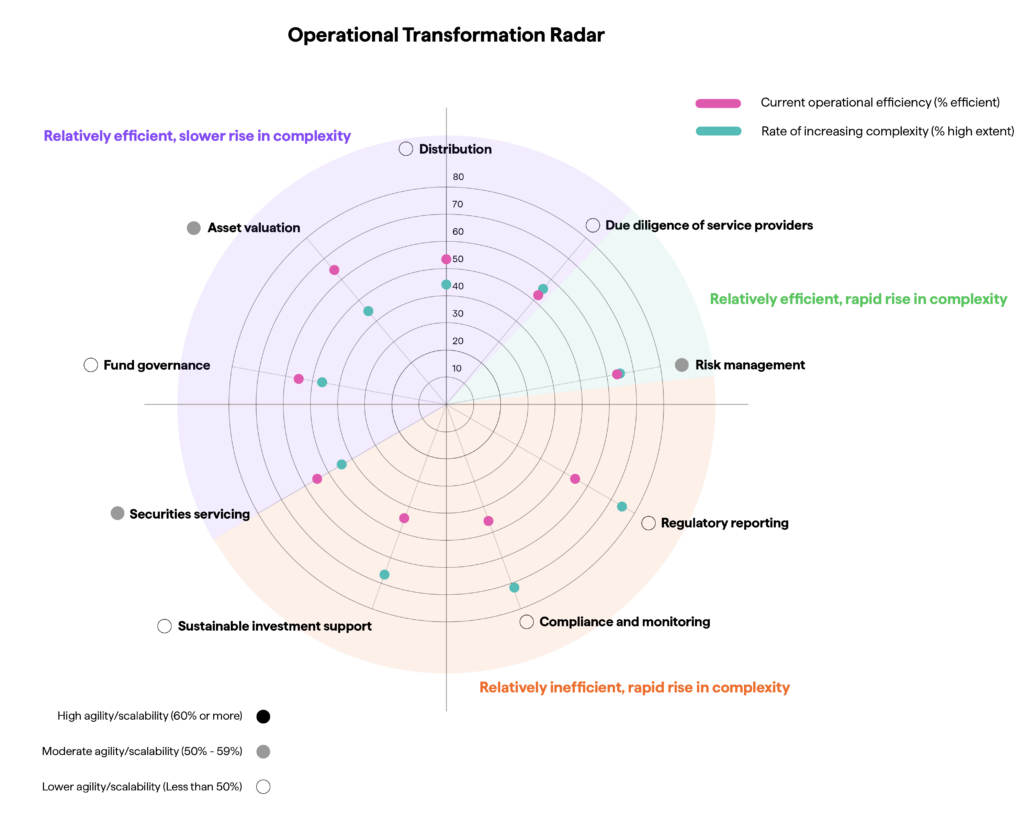

In this Pinpoint of view article, we use our Operational Transformation Radar to set out the areas of greatest inefficiency and complexity – arguing these require the most urgent attention.

Supermodel: The great evolution in asset management

Download part three: Operational Transformation Radar

Operational Transformation Radar – mapping operational efficiency

Our Supermodel analysis, based on the expert views of 200 asset management executives, allowed us to create an Operational Transformation Radar. This peer analysis examines operational pain points faced by asset managers and shows that internal teams are treading water. They are struggling to make progress on regulatory reporting, compliance, monitoring and sustainable investment support.

Much of this comes from the lengthening shadow of regulation. Our radar, below, shows that obligatory reporting is an outlier, measured by comparatively low operational efficiency and increasing complexity. As one industry leader says:

“It’s a different process [to the US] – we’re getting a lot of questions from regulators and it’s taking longer than we would like, and there are new skill sets to build, so there’s a bit of hiring needed to bring in some people with that knowledge base in Europe.”

Traditional global asset manager

Moreover, our expert respondents scored compliance and monitoring at well under 50% efficiency. This finding comes hand in hand with something that should come as no surprise to operations leaders: operational complexity is also an effect of client requests for customisation.

One of our research respondents commented:

“Investor demands for customisation are a key factor in driving the increased middle and back-office burden for us. They might request for a strategy to be levered, or to introduce a level of interest rate hedging, or currency hedging – and that leads to more monitoring demands from a compliance and risk management perspective.”

European alternative manager

Operational headaches surrounding launching and distributing funds are slowing down market entry and reducing profit margins. According to our survey, nearly two-thirds (63%) of firms report that it now takes 10 months or more to launch a typical fund. For example, the difficulty of obtaining regulatory approval to launch an Irish or Luxembourg-domiciled active ETF presents a challenge for asset managers.

To be fit for purpose in the face of such pressures requires more cost-efficient operating models. Organisations that can accomplish this can then move towards healthier profit margins, improved scalability and a more stable platform from which to meet new demands.

Firms that partner with trusted providers for non-core tasks can focus on performance, product development, and client value, ultimately accelerating speed to market in a cost-effective and scalable way.

How does your operating model compare? Our Operational Transformation Radar can benchmark your efficiency, scalability and rising complexity. Whether you’re a public market, private market, boutique or global manager, speak to us to find out how you rank against your peers when it comes to operational efficiency. We will be happy to arrange a meeting to discuss your ranking and some further detail on the recommendations of the report. contact@carnegroup.com

Download part three here to learn more.