Change 2025: Outsourcing is optimising – Mark Stockley, Chief Business Development Officer

The investment industry is entering a new age. Tougher competition, tightening margins and stringent regulatory oversight are putting pressure on fund managers. At the same time, institutional investors are demanding diversification in the face of continued market volatility – and all while expecting better governance and higher standards.

Amid the complexity, Carne’s second annual Change report tells a story of both headwinds and tailwinds – fund managers and institutional investors alike are predicting a growth fuelled year ahead despite facing these mounting pressures. We surveyed 251 C-suite fund management executives and 200 institutional investors, collectively responsible for $4.6 trillion assets under management, on their strategy for the year ahead.

Change 2025 is essential reading to navigate tomorrow’s opportunities.

Change 2025: Outsourcing is optimising

Mark Stockley, Chief Business Development Officer

Managers under the microscope

Our research into the expectations of hundreds of investment industry senior professionals is underpinned by a clear preference for outsourcing.

A significant majority of the 451 asset management executives we spoke to for Change 2025 are partnering with third-party specialists for three specific and important needs. Firstly, they must keep pace with evolving investor demand and increasing scrutiny; secondly to deliver growth strategies and new products; and thirdly to achieve cost savings. For smaller firms these are critical if they want to retain their independence.

The first of the structural shifts driving outsourcing sees managers under the microscope.

There is a surge in client scrutiny, focused especially on manager reporting, transparency and corporate governance. For example, 87% of institutional investors rejected a fund manager in the last three years because of their poor standards of corporate governance.

Managers are responding in two ways:

- They are improving internal processes. This is already making a difference to clients, 76% of whom see improvement in infrastructure managers’ governance, with 72% saying the same for real estate. Other asset classes display similar numbers.

- They are outsourcing. Fund managers themselves acknowledge that third-party providers help them meet the client need for higher standards, better reporting and more transparency. Moreover, a striking 88% believe they must increase their use of such specialists over the next 12 months, with 49% predict a dramatic increase.

Of course, outsourcing non-core, essential functions is also a growth enabler. Managers can become more efficient thanks to an appropriate partner’s specialist knowledge, infrastructure and technologies.

Bullish predictions – sweeping visions

The product and distribution capabilities of third parties may also hold the key to unlocking growth from new asset classes, products and markets – according to the asset management executives we spoke with.

A crucial path to growth is fund flows. Here, optimism abounds. Our study found 81% of fund managers expect the flow of new capital into their funds and segregated accounts to increase during 2025.

The volume of new capital brought by such flows will be significant. More than two-thirds say flows will be 10% to 25% greater than in 2024 – and 27% expect flows up to 50% higher. These are some of the most bullish predictions across any of our Change reports.

To realise these growth ambitions managers require appropriate opportunities to gather assets and deploy them in strategies that deliver the risk and returns their clients need. This is why 88% are planning to raise assets overseas.

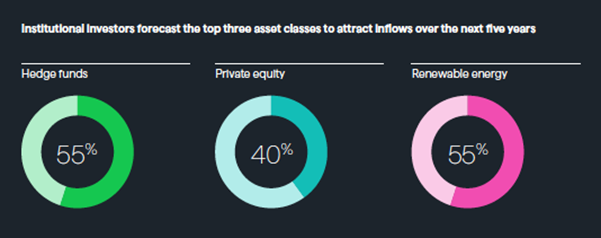

It is also why 84% expect the number of new funds launching in their sector to exceed 2024. Most managers now see ETFs as a core holding and – given public market volatility – private markets, hedge funds and other alternatives continue to be the asset classes of choice to enable growth.

Growth strategies will inevitably involve taking new products to market, occasionally within new asset classes. If we take ETFs as an example of a key growth driver, the majority of the C-suite fund managers we spoke with are outsourcing to overcome regulatory, operational and resource constraints when bringing ETFs to market. 64% will use third parties to select service providers, 57% to prepare prospectuses and legal documents, and 53% for help with submissions to the regulator.

Smaller firms find a way to compete

The complicated and convoluted nature of modern investment regulation continues to pose problems for managers: almost all (98%) of managers say regulation will become more complicated by 2027 – and even more (99%) of institutional investors agree.

This is one of several pressures begetting market consolidation. The extra trial of fundraising challenges could well lead to the number of private market fund managers shrinking. Some 88% of fund managers believe consolidation will increase over the next five years, across all asset classes.

Smaller firms have a choice: give in to consolidation or pivot to third-party outsourcers and survive, with independence unharmed.

Turning to specialist third parties for regulatory compliance and to meet high investor standards enables smaller firms to survive such pressures.

As we have long argued, outsourcing can enable a smaller manager – as well as larger ones – to devote more internal resource and bandwidth to the things that make the greatest difference to underlying investors: investment performance and client service.

If you would like to know more about the report – or how Carne can support your organisation in navigating change successfully, contact@carnegroup.com.

You can also Download the full report to learn more.