The supermodel era: Future proofed operations – Sheila Rohan, Managing Director, Client Operations and Pascal Dufour, Group Chief Product and Strategy Officer

The Supermodel era: Future proofed operations – Sheila Rohan, Managing Director, Client Operations and Pascal Dufour, Group Chief Product and Strategy Officer

Pinpoint of view

Asset management operating models are changing. New products and new distribution models have transformed the industry. This has brought benefits and growth – but also costs and complexity. To succeed, asset managers now require leaner, more agile operating models that allow them to prioritise performance, products, distribution and clients. Our latest research initiative[i] shows that this is propelling asset managers into a supermodel era, of necessary, radical and lasting change to operating models.

In this Pinpoint of view document, we examine the modernisation of technology infrastructure as a way forward to future proof operating models. We also acknowledge the multi-dimensional challenges which come from a project of this scale and point to some solutions.

Supermodel: The great evolution in asset management

Technology modernisation- the (not so) simple way to future proof

Operations leaders say their models are becoming increasingly stretched – and they need to transform to accomplish asset growth and long-term profitability.

They believe they must address margin challenges by modernising their technology infrastructure. This includes deeper automation, advanced tools like machine learning and artificial intelligence (AI), and centralised data management.

But what if they’ve already taken simple steps? How can they reach the higher hanging fruit?

Further technology-driven efficiency gains are not simple to achieve. For example, we have found many firms lack sufficient understanding of AI to develop use cases.

“I’m sure there’s a bigger role for automation and AI, but it can be hard to identify which aspects of governance and regulatory compliance can really be transformed as you have to know the rules inside out in Europe.”

Managing Director, traditional global asset manager

Often, for firms operating proprietary management companies the challenges of scaling up their technology infrastructure and data centralisation are vast to say the least. Another hurdle is money: it is difficult to secure the Capex to keep pace with new technology – let alone outpace competitors.

So, they do their best. Digital transformation projects become multi-year projects. Existing systems are adapted to new workloads along the way as growth strategies. They try to run faster in order to close that gap between themselves and front-office driven growth.

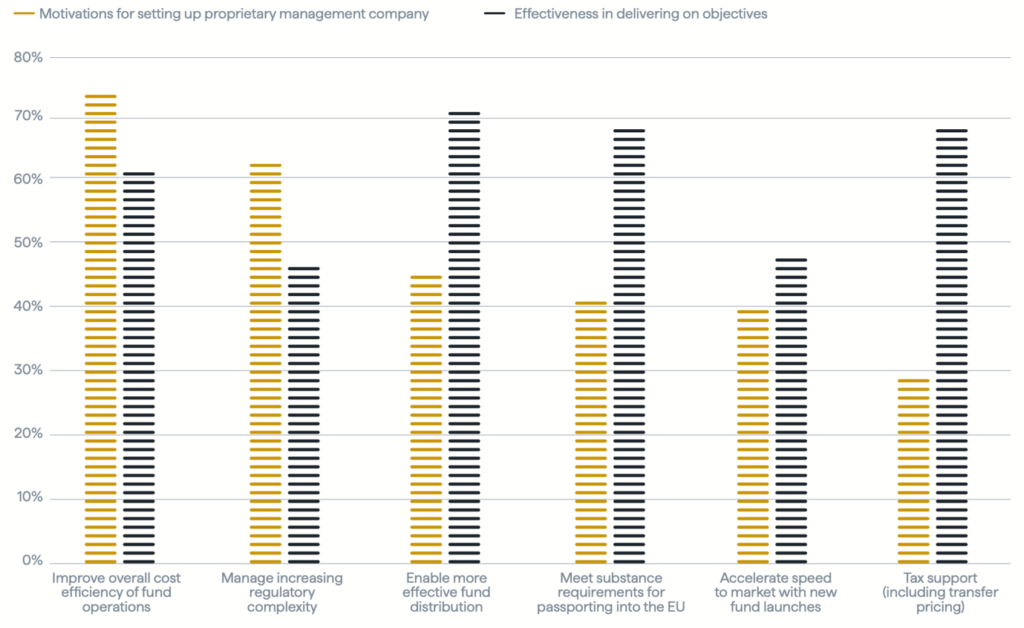

Motivations for establishing proprietary management companies versus effectiveness in meeting objectives

This has two important implications for outsourcing strategies:

- 51% of firms running proprietary management companies plan to outsource more specific functions using a managed services model over the next two years.

- 29% of firms want to fully outsource management company responsibilities specifically to support new products.

Given proprietary management companies now oversee 89% of the industry’s $16.45trn in

assets across Ireland, Luxembourg and the UK[ii], this would represent substantial growth in the third-party asset pool.

As this supermodel transformation plays out, operating models will undergo radical change.

If our analysis mirrors your organisation’s challenges, we would be happy to discuss our research in detail – and propose ways you can evolve. Please get in touch on contact@carnegroup.com

Download the full report here to learn more.