Under pressure: Two thirds of asset managers expect a significant rise in margin pressure in the next two years

Under pressure: Two thirds of asset managers expect a significant rise in margin pressure in the next two years |

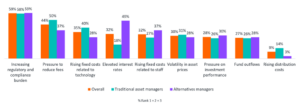

November 2024 – The asset management industry is set to face increased commercial pressures in the next two years, with two in three (65%) of asset management executives expecting a significant increase to margin pressure in this period.1 The findings from Carne Group’s four-part research series Supermodel: The great evolution in asset management – which surveyed 200 asset management executives on commercial pressures their businesses are set to face in the coming two years. The research found that fee pressure, regulation and operating costs are coalescing to further challenge asset managers’ profitability. With the continued rise of passive and anticipated market volatility, traditional managers are set to be hit harder, with 72% of executives expecting increased pressure compared to 56% of their counterparts at alternative firms. However, alternative managers are not without their own challenges in the coming period. Regulation, market volatility and tech adoption weigh down future margins The growing regulatory and compliance burden, with the integration and management of regulation set to be the key contributor to margin pressure, cited by 59% of asset managers. The market backdrop is also contributing to margin pressure, 30% of asset managers note volatility in asset price is set to weigh on margins in the coming two years, with a similar number also citing pressure on investment performance (28%). A drive to integrate technology and the latest innovations is also set to eat into margins, with 35% of asset managers citing fixed costs relating to technology affecting their bottom line over this period. Notably, there is a divergence between traditional asset managers and alternative managers, 40% versus 28% respectively, highlighting that the uptick in tech investment is going to be more burdensome for traditional managers. Factors contributing most to decreased profit margin pressure over next two years

Growth of passive provides a cost challenge for traditional managers Downward pressure on fees, driven by the rise of passive investment and increased scrutiny by both clients and regulators on value, is prompting significant challenges for traditional managers. Half (50%) of traditional asset managers have cited the pressure to reduce fees as a key contributor to decreased profit margins in the near future. Actively managed funds are facing greater pressure to reduce costs, almost half (47%) of traditional managers expect to face increased pressure on profit margins across their suite of actively managed public funds, though passive funds are not immune from this downward pressure, with 36% expecting high levels of fee pressure on passively managed public funds. At an asset class level, managers think margin pressure will increase to a high extent for equity funds (51%) and bond funds (52%) over the next two years, as competition from passive products in these markets shows no signs of abating. Multi-asset funds (48%) are expected to suffer slightly less. By comparison just 29% expect a significant increase in margin pressure for private markets funds and hedge funds. As a result, the majority (73%) of traditional asset managers expect to undertake some level of product rationalisation, with actively managed funds in public markets (38%) the main target for this. Elevated interest rates and the war for talent creates challenges for alternative managers While the commercial pressures facing traditional managers are more acute, alternative managers are not without their own challenges. Despite central banks having begun a rate cutting programme, elevated interest rates are still expected to pose a profitability challenge for 49% of alternative managers as those managers reliant on leverage grapple higher borrowing costs. The fierce competition for talent that has been ignited in the alternatives space is also proving a challenge for these managers, with higher wage bills cited by 37% of alternative managers as a near-term challenge, compared to just 27% of traditional managers. Asset managers look to outsource to address margin pressures Against this backdrop, asset management firms are looking at their operational models to alleviate pressure on margins. While increased technology spend is cited as a near term pressure, it’s expected to yield long-term solutions with digital technologies and automation perceived as the operating model initiatives that could be most effective in reducing margin pressure. Almost half (47%) of managers also see outsourcing of non-core activities as a means to help improve their profit margin. With regulatory complexity cited as the greatest contributor to margin pressure, 51% of asset managers with their own management company expect to outsource some of their services to a third-party management company (ManCo) in the next two years to tackle this challenge head on, while 19% expect to fully outsource these services to a third party ManCo. John Donohoe, CEO of Carne Group comments: “The commercial pressures facing the asset management industry are set to heighten yet again in the coming two years. Traditional managers are facing particularly acute pressure with the continued rise of passive, however alternative managers are not immune to this pressure either and face their own challenges in the form of cost of capital and higher wage bills. “With industry competition mounting and market volatility becoming the new normal, asset managers are looking to ‘control the controllables’ to make their businesses more efficient and streamlined. “With regulation increasing, diverging, and becoming more expensive to navigate, one area they’re targeting is regulatory oversight. Firms are increasingly recognising the value that an outsourced management company can bring, not only enabling them to reduce headline costs associated with regulatory oversight but also improving regulatory compliance by providing access to dedicated and specialist expertise.” Speak to us: if you would like to understand the research more or how you compare to your peers, please get in touch contact@carnegroup.com |