The supermodel era: Managers expect margin pressure to build – Des Fullam, Group Chief Regulatory & Client Solutions Officer

The supermodel era: Managers expect margin pressure to build – Des Fullam, Group Chief Regulatory & Client Solutions Officer

Pinpoint of view

Asset management operating models are changing. New products and new distribution models have transformed the industry. This has brought benefits and growth – but also costs and complexity. To succeed, asset managers now require leaner, more agile operating models that allow them to prioritise performance, products, distribution and clients. Our latest research initiative [i] shows that this is propelling asset managers into a supermodel era, of necessary, radical and lasting change to operating models.

In this Pinpoint of view article, we assess the factors that are putting pressure on margins.

Supermodel: The great evolution in asset management

Download part one: Under Pressure here

The cost of compliance, and then some

Managers expect their margins to come under increasing pressure over the next two years.

This focus on margins is likely to be more intense than before. Lower fees are pushing the revenue more firmly downwards – and fixed or rising costs apply upward pressure.

Our research with 200 senior leaders in operations, finance, risk and distribution identifies the factors that weigh downwards or push upwards.

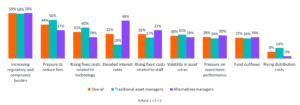

As you can see in the image below, the growing regulatory and compliance burden is at the top of everyone’s lists. The obligation to comply with larger numbers of ever-more complex rules and laws is pushing up operating expenses for both traditional and alternative managers.

Alongside this issue comes the cost of expert staff. Full time employees are, of course, a fixed cost. And it is rising. For example, salaries in the risk and compliance sector rose by between 7 and 10% in 2023[ii]. Inflation was just 5.1%[iii].

The pressure – from clients and distributors – to reduce the fee for supplying investment performance is also a critical factor. If you are a traditional manager, this is almost as significant a concern as the burden of compliance.

Factors contributing most to increased profit margin pressure

This pressure to reduce fees is something weighing on alternatives managers too. Indeed, 37% say that pressure is more significant than most of their other considerations.

“I’d be surprised if that level of enthusiasm and acceptance of fee levels [in private credit] is maintained over the next decade.”

Global alternatives manager

Alternatives manages are not immune from margin concerns. Leverage can be a key component to private credit, infrastructure, and other non-traditional strategies and can makes these managers sensitive to rising interest rates. As returns are impacted, these managers must also consider how to deal with margin compression.

This analysis quantifies the increasing forces weighing most heavily on asset management business models. They must be addressed and alleviated.

If our work reflects your experience, we would be delighted to discuss it further and address your unique requirements. Please contact us at contact@carnegroup.com

Download part one here to learn more.

[i] Research of 200 asset management executives conducted by Core Data in Q3 2024.