The supermodel era: Industrial sized growing pains – Mark Stockley, Chief Business Development Officer

The supermodel era: Industrial sized growing pains – Mark Stockley, Chief Business Development Officer

Pinpoint of view

Asset management operating models are changing. New products and new distribution models have transformed the industry. This has brought benefits and growth – but also costs and complexity. To succeed, asset managers now require leaner, more agile operating models that allow them to prioritise performance, products, distribution and clients. Our latest research initiative [i] shows that this is propelling asset managers into a supermodel era, of necessary, radical and lasting change to operating models.

In this Pinpoint of view, we examine how new asset classes and products impede operational effectiveness.

Supermodel: The great evolution in asset management

Download part two: Operational Overhaul here

New asset classes, new challenges

The search for growth strategies is posing complex problems for internal operations functions.

Managers seeking increased returns and diversification are pushing more into sustainable funds, active ETFs and private markets. For example, Carne analysis [ii] shows that investments in private assets are likely to rise 62% to $21 trillion by 2030.

“Privates are certainly top of our list … and we have a healthy active ETF business in the US so we’re hoping to build that in Europe. We’re trying to be in more of those market growth areas.”

Global asset manager

Managers are moving in this direction to counteract the combined issue of eroded margins and weak client flows into active, public markets funds.

However, our latest research highlights the material implications associated with such growth. Entering new asset classes (55%) and expanding sustainable investment products (46%) create the greatest internal issues for operations teams and processes.

The effects of new asset classes and product vehicles on operations teams – in a cost constrained environment – mean greater complexity, to be solved by limited and potentially inexperienced resources.

“Despite all efforts, it can feel that growth is synonymous with complexity, with operations required to absorb and support ever increasing product and client complexities.”

Global alternatives manager

Over half (52%) of the respondents to our latest research say their firm’s growth strategies are leading to increased operational inefficiencies.

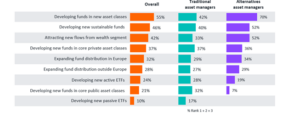

When we asked executives to identify specific challenges, they placed developing funds in new asset classes at the top of the list. While this is certainly the case for traditional managers alternatives managers were emphatic in their response: 70% of them cite this issue.

Growth strategies most challenging to support from an operational perspective

New asset classes bring new data and reporting demands, different regulatory requirements and novel fund structures. Sustainable fund launches pose complexities, as operations teams try to keep pace with changing regulations and minimise compliance risk.

Some of our respondents are clearly resigning themselves to having two separate operating models … with all the implied costs and complexities that would bring.

“I think we’re going to end up having an operating model which is tuned to long-only and an operating model which is tuned to our private markets investments.”

Global asset manager

At what point do such pressures become unbearable? Moreover, to what extent should managers outsource some or all these functions, to focus on their core business of managing money?

If our analysis resonates with your experience, we would be delighted to discuss it further and address your unique requirements. Please contact us on contact@carnegroup.com

Download part two here to learn more.